Introduction:

The Risks of Chinese Loan Apps: Why You Should Exercise Caution

Chinese loan apps have gained popularity in recent years, offering quick and convenient access to funds. However, it’s crucial to understand the potential risks associated with these apps. In this article, we will explore the reasons why you should exercise caution and avoid Chinese loan apps.

- Lack of Regulation and Oversight: Chinese loan apps often operate in a regulatory environment that may be less stringent compared to other countries. This lack of oversight increases the risk of predatory lending practices, exorbitant interest rates, and unfair loan terms. Without proper regulations, borrowers are left vulnerable and may face financial difficulties.

- Data Privacy and Security Concerns: Chinese loan apps have faced significant scrutiny regarding data privacy and security. Some of these apps have been accused of collecting excessive personal information, potentially sharing it with third parties without consent. This raises concerns about the misuse of sensitive data and the potential for identity theft or fraud.

- Invasive Collection Practices: Chinese loan apps have been known to employ aggressive and invasive debt collection practices. Borrowers who are unable to repay their loans on time may experience harassment through constant calls, messages, and even public shaming. Such practices can cause immense stress and negatively impact the borrower’s mental well-being.

- Hidden Fees and Unfair Practices: Chinese loan apps have been associated with hidden fees, misleading terms, and unfair practices. Borrowers may encounter unexpected charges, unclear repayment terms, or sudden changes in interest rates. These practices can lead to financial strain and make it challenging for borrowers to repay their loans as originally agreed.

- Difficulties in Dispute Resolution: Resolving disputes with Chinese loan apps can be challenging. The apps often have complex customer service processes, language barriers, and limited responsiveness to customer complaints. This lack of effective dispute resolution mechanisms can leave borrowers in a vulnerable position, with limited options for recourse.

- Potential for Fraud and Scams: Due to the lack of stringent regulations, Chinese loan apps may attract fraudulent actors who exploit unsuspecting borrowers. Scammers can create fake loan apps or use deceptive tactics to trick individuals into providing personal information or making upfront payments. It’s essential to remain vigilant and cautious when dealing with unfamiliar loan apps.

Do the agents of Loan Apps company blackmail the customers to pay the installments?

Yes, some loan app company agents do blackmail customers to pay the installments. They may threaten customers that they will leak their personal information, take legal action against them, or harm their family if they do not pay the installments.

If you are being blackmailed by a loan app company agent, you should take immediate action. You can file a complaint with the police, or you can seek legal advice from a lawyer.

Here are some things you can do in case of blackmail:

- File a complaint with the police immediately.

- Seek legal advice from a lawyer.

- Inform the loan app company in writing that you are being blackmailed.

- Block the blackmailer.

- Do not respond to any calls or messages from the blackmailer.

- Do not engage with the blackmailer in any way.

It is important to remember that blackmail is a crime. If you are being blackmailed by a loan app company agent, you should take immediate action.

Here are some additional tips to protect yourself from loan app scams:

- Only download loan apps from legitimate sources, such as the Google Play Store or the Apple App Store.

- Read the terms and conditions carefully before you apply for a loan.

- Be aware of the interest rates and fees associated with the loan.

- Do not give out your personal information to anyone you do not trust.

- If you are having trouble making your payments, contact the loan app company directly.

Do recovery agents force morphing obscene photos to pay off loans and threaten to make the photos viral?

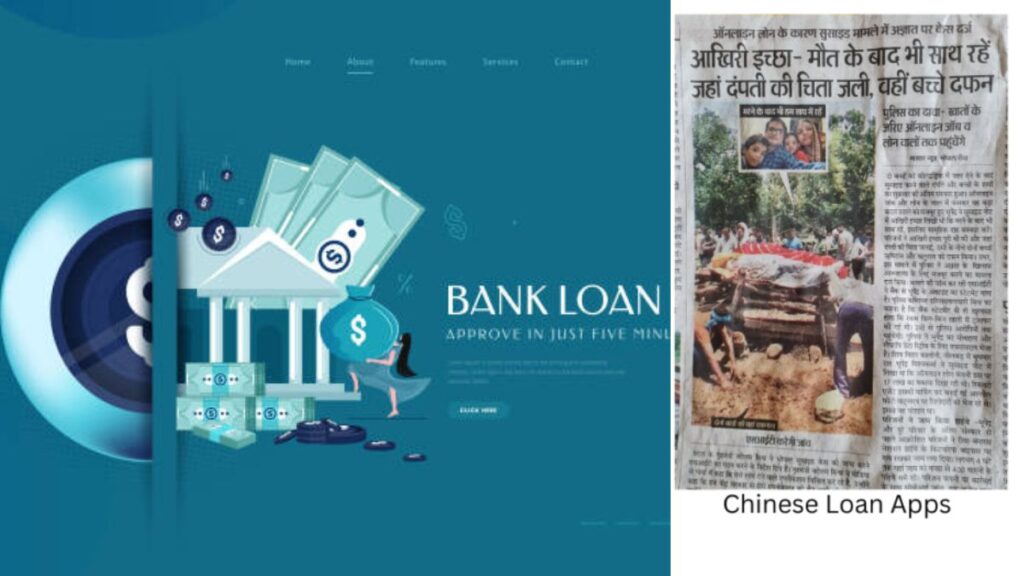

Yes it is absolutely true. Such a true and heart-wrenching incident happened with Bhupendra, a resident of Neelbad, Bhopal. Whose news paper report I am sharing with you, which happened recently on 12th or 13th July 2023, in which recovery agents were threatening to make Bhupendra’s photo viral among relatives through morphing.

As a result of which Bhupendra got fed up and committed suicide along with his wife and 2 children and all of them were cremated together.

How to avoid the tempting trap of Chinese loan apps, what precautions should be taken?

Here are some precautions you can take to avoid the tempting trap of Chinese loan apps:

- Only download loan apps from legitimate sources, such as the Google Play Store or the Apple App Store.

- Read the terms and conditions carefully before you apply for a loan. This includes the interest rates, fees, and repayment terms.

- Only take out a loan that you can afford to repay. Don’t be tempted by high-interest rates or low monthly payments.

- Be wary of any loan app that asks for a lot of personal information, such as your bank account number or social security number. These apps may be using your information for fraudulent purposes.

- If you have any problems with a loan app, contact the company directly. Don’t be afraid to ask for help if you’re struggling to make your payments.

Here are some additional tips to help you stay safe from Chinese loan app scams:

- Be aware of the signs of a scam. These include offers that seem too good to be true, pressure to apply for a loan immediately, and requests for personal information that is not necessary for the loan process.

- Do your research. Before you apply for a loan, check the company’s reviews online and make sure they are legitimate.

- Trust your gut. If something seems off, it probably is. Don’t be afraid to walk away from a loan app if you’re not comfortable with it.

By following these tips, you can help protect yourself from Chinese loan app scams and avoid falling into a debt trap.

Here are some additional resources that you may find helpful:

- The Reserve Bank of India’s (RBI) website: https://www.rbi.org.in/ has information on how to identify and avoid loan app scams.

- The National Consumer Helpline: https://consumerhelpline.gov.in/ can provide assistance if you have been a victim of a loan app scam.

- The Cybercrime Investigation Cell: https://www.cybercrime.gov.in/ can investigate reports of loan app scams.

Conclusion:

While Chinese loan apps offer convenience and quick access to funds, it is important to be aware of the potential risks involved. Lack of regulation, data privacy concerns, invasive collection practices, hidden fees, and difficulties in dispute resolution are among the reasons why exercising caution and avoiding Chinese loan apps is advisable. Prioritize your financial security and opt for reputable loan providers that operate under transparent and regulated environments.

FAQ

Frequently Asked Questions About Risks Associated with Chinese Loan Apps: Why Caution is Advised

- What are Chinese loan apps?

Chinese loan apps are mobile applications developed by companies based in China that offer quick and easy access to small loans to individuals, often with minimal documentation requirements and fast approval processes.

- What are the risks associated with Chinese loan apps?

There are several risks involved, including exorbitant interest rates, hidden fees, privacy concerns (such as excessive data collection), aggressive debt collection practices, and potential links to illegal or unethical activities.

- Why should caution be exercised when using Chinese loan apps?

Caution is advised due to the aforementioned risks, which can lead to borrowers falling into debt traps, compromising personal data, or facing harassment from aggressive debt collectors.

- How do Chinese loan apps typically operate?

Chinese loan apps typically operate through mobile platforms, offering loans that are disbursed and repaid electronically. They often target individuals who may have difficulty accessing traditional banking services or who need quick cash for emergencies.

- Are Chinese loan apps regulated?

Regulation of Chinese loan apps varies depending on the country. While some countries have implemented regulations to monitor and control their activities, others may have lax oversight, leaving borrowers vulnerable to exploitation..

REFERENCES

here are some references related to the risks associated with Chinese loan apps:

- Custer, C. (2020). The Trouble with Chinese Fintech. The Diplomat. [Online] Available at: https://thediplomat.com/2020/01/the-trouble-with-chinese-fintech/

- Kang, J., Lee, J., & Rhee, C. (2020). Chinese Tech Companies Are Collecting Personal Data and Violating Your Privacy. Medium. [Online] Available at: https://medium.com/swlh/chinese-tech-companies-are-collecting-personal-data-and-violating-your-privacy-87f28a14cfb9

- Maksimovic, M. (2019). How China’s Loan Apps Saddle Borrowers with Risk. TechNode. [Online] Available at: https://technode.com/2019/03/21/chinas-loan-apps-borrower-risk/

- Ahmed, S. (2021). The Dark Side of Chinese Lending Apps: Harassment and Suicides. Al Jazeera. [Online] Available at: https://www.aljazeera.com/economy/2021/5/21/the-dark-side-of-chinese-lending-apps-harassment-and-suicides

- Liu, B. (2020). China to Curb Risks from Online Lending with New Rules for Fintech Giants. South China Morning Post. [Online] Available at: https://www.scmp.com/economy/china-economy/article/3110120/china-curb-risks-online-lending-new-rules-fintech-giants

- Wang, Y. (2019). China’s Online Lending Is a $200 Billion Market – And It’s Causing Concern. CNN Business. [Online] Available at: https://www.cnn.com/2019/12/03/tech/china-p2p-online-lending-intl-hnk/index.html

- Rashid, S. (2021). The Unseen Dangers of Chinese Loan Apps. The Diplomat. [Online] Available at: https://thediplomat.com/2021/10/the-unseen-dangers-of-chinese-loan-apps/

- Xinhua. (2021). China Unveils New Measures to Regulate Loan Apps. XinhuaNet. [Online] Available at: http://www.xinhuanet.com/english/2021-06/16/c_1310011429.htm

- Rana, P. (2020). Privacy Policy of 54 Chinese Apps Under the Indian Government’s Scanner. The Hindu. [Online] Available at: https://www.thehindu.com/sci-tech/technology/privacy-policy-of-54-chinese-apps-under-the-indian-governments-scanner/article32551605.ece

- World Bank. (2018). Digital Dividends: World Development Report 2016. World Bank Publications. [Online] Available at: https://openknowledge.worldbank.org/handle/10986/25026

These references should provide a comprehensive overview of the risks associated with Chinese loan apps and the need for caution when using them.